WINLED (HK) CABLES & WIRE PRODUCTS CO. LTD V. VELANKANI ELECTRONICS PVT. LTD.

Rep. By its Authorised Person Mr. Priyavart Chaudhary

Room No. 5/3 F, Shun On Commercial Building No. 112-114

Des Voad, Central HK.

And at: No. 1004, Sector 9, Vasundara,

Ghaziabad – 201 301

Versus

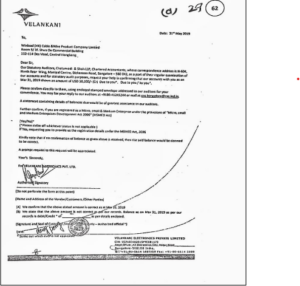

M/s Velankani Electronics Pvt. Ltd.

Block VIII, 1st Floor, Electronic City,

Phase 1, Sy. No. 43, Hosur Road,

Bengaluru – 560 100.

Case No: COMPANY APPEAL (AT) (CH) (INS.) NO. 280/2021

[Justice M. Venugopal] [Shreesha Merla] For Appellant : Mr. E. Om Prakash, Sr. Advocate For Mr. Ajaykumar, Advocate Facts Referred Sections and Laws Download Court Copy: https://dreamlaw.in/wp-content/uploads/2023/12/Winled-HK-Cables-Wire-Products-Co.-Ltd.-v.-Velankani-Electronics-p-2.pdf Full Text of Judgment: [Per: Shreesha Merla, Member (Technical)] 5. The Learned Counsel drew our attention to the letters dated 06/07/2022 and 16/08/2022 addressed to the Branch Manager, SBI stating that the reason for delay in payment towards the above imports is that there was a quality dispute We are currently facing a 15% rejection rate due to pin breakage, as the picture in the mail trail reflects. T. Senthilkumar And I try to broken the connector, its hard to snap the pin in one hand, atually this cagro connector even more better and expensive than before 125K 7. On a pointed query from the bench regarding the admission of liability as on 31/05/2019 subsequent to the trail emails, the Learned Counsel for the Respondent replied that this amount was not reflected in the balance sheet. The Learned Counsel for the Respondent placed reliance on the Judgment of this Tribunal in the matter of ‘Asset Reconstruction Company (India) Limited Vs. Uniworth Textiles Limited’ in Company Appeal (AT) (Insolvency) No. 991/2020, in support of his argument that acknowledgement in balance sheet cannot be a proof of existence of Debt and Default for initiating CIRP Process and that the overall eco-system of the transaction should be taken into consideration. In the instant case, what is required to be seen is the letter dated 31/05/2019 which, for ready reference, is reproduced as hereunder: 8. From the aforenoted letter addressed by the Corporate Debtor to the Appellant / Operational Creditor, it is clear that the accounts were confirmed showing an amount of US $ 50,200. The contention of the Learned Counsel for the Respondent that this amount is not shown as due and payable in their financials, pales into insignificance, taking into consideration that this letter has been signed by the Authorised Signatory of the Corporate Debtor and it is clearly stated that the said amounts have been ‘examined by their Statutory Auditors’ and to ‘confirm’ the said amount. Further, this Tribunal is of the considered view that having admitted that this amount is due and payable and having agreed to pay the said amount in two tranches, a sum of $20,000 by the end of May 2021 and the entire balance by the end of July 2021, the Corporate Debtor cannot now turn around and say that there was a dispute and that the amounts are not due and payable. Keeping in view the facts of the attendant case on hand, this Tribunal is of the considered view that the Judgment of ‘Asset Reconstruction Company (India) Limited Vs. Uniworth Textiles Limited’ (Supra) is not applicable to the facts of this case. Specifically, since there was a clear acknowledgement of payment of the amounts in two tranches within specific time periods. 9. The Adjudicating Authority cannot initiate CIRP against solvent company that too in present pandemic situation prevailing in the Country adversely affected its economy. 10. For the aforesaid reasons and circumstances of the case and the law on the issue, we are of the considered opinion that the instant Petition is filed solely with an intention to recover the outstanding amount treating Adjudicating Authority as recovery forum, which is against the object of Code. Therefore, the Petition is liable to be dismissed. 10. It is settled law that what has to be seen is whether a dispute raised is spurious or genuine. Keeping in view the documentary evidence on record, this Tribunal is satisfied that the dispute raised is a spurious one specifically having Connected Pending Interlocutory Applications, if any, are ‘closed’.Date of Judgement: 02.08.2023

Judges:

Member (Judicial)

Member (Technical)

For Respondent : Mr. Ramasubramaniam Raja, Advocate

Elaborate Opinions of the Court

Settlement Agreement dated 25/03/2021 shows the Corporate Debtor agreed to pay the dues in 2 tranches. This establishes the debt and default, and refutes the claim of dispute raised by Corporate Debtor. Judgment relied upon by NCLT regarding initiation of CIRP against solvent companies is not applicable in facts and circumstances of this case. Objection regarding requirement of RBI approval is also rejected since debt is due and payable since May 2018, much before insertion of Section 10A in IBC. Mere non-reflection of debt in balance sheet does not invalidate admission of liability by Corporate Debtor through specific letter examined by their Auditors. Dispute sought to be raised is spurious and initiation of CIRP cannot be denied on this ground.

Conclusion

Appeal allowed and the impugned order of NCLT set aside. Matter remanded to NCLT for initiation of CIRP against the Corporate Debtor.

1. Challenge in this Company Appeal (AT) (CH) (Ins) No. 280 of 2021 is to the Impugned Order dated 09/04/2021 passed in CP(IB) No. 178/BB/2020, whereby the Application under Section 9 of the Insolvency and Bankruptcy Code, 2016 (hereinafter referred to as ‘the Code’) filed by the ‘M/s Winled (HK) Cable and Wire Product Company Limited’ / ‘Operational Creditor’ / ‘the Appellant’ herein was dismissed by the ‘Adjudicating Authority’ on the ground that the Application was filed solely with an intention to recover the outstanding amount.

2. The Learned Counsel for the Appellant / Operational Creditor submitted that they supplied high quality RCA Cables, DC Cables, HDMI Cables to the Respondent / Corporate Debtor to a tune of Rs. 35,78,256/- evidenced by invoices and the said outstanding amount remained due and payable since May 2018. It is submitted that a letter dated 31/05/2019 was also addressed by the Respondent admitting the liability of US $50200 amounting to Rs. 35,78,256/-. A statutory Demand Notice dated 31/08/2019 under Section 8 of the Code issued to the Respondent which did not choose to reply, subsequent to which the Section 9 Application was filed and during the course of proceedings a Settlement Agreement dated 25/03/2021 was circulated by the Corporate Debtor. It is also submitted that though the Tribunal vide Order dated 12/04/2022 had permitted the Respondent to file Reply on both modes within two weeks, no reply was received even as on the date of filing of written submissions. It is submitted that Section 10A has been inserted in the Code restricting the filing of any Application for initiating CIRP of a Corporate Debtor for any default arising after 25/03/2020 for a period of 6 months or such further period not extending to one year from 25/03/2020. It is argued that the said ordinance is not retrospective and the default period in this case is to be calculated from May 2018 onwards and Section 10A is not applicable to the facts of this case. It is also denied that since imports were more than 6 months old, an RBI approval is required and that the Respondent is submitting the details required by the AD Bank to facilitate RBI Approval and remittances of US$ 50200. It is vehemently denied that any such approvals were ever tendered.

3. The Learned Counsel for the Respondent submitted that the Respondent was making regular payments to the Appellant on the invoices raised by it and an amount of $55,107.80 was already paid. It was only after noticing some shipping defective products that dispute aroused and it was agreed that the value of the rejections would be deducted from the outstanding payments. It is stated in the ‘Statements of Objections’ filed before this Tribunal that the Respondent as all

along conveyed that it was willing to settle the actual dues to the Appellant and it even proposed a payment schedule but the Appellant had rejected the same as it wanted the entire payment to be released in a single transaction. It is submitted

that the very fact that the Respondent had proposed to make the payments in two tranches clearly shows that the Respondent is a solvent Company and therefore, initiation of CIRP against a solvent company is against the objective of the Code.

4. It is submitted that RBI’s approval is required in respect of imports made more than 6 months earlier and the same was paid by the ‘AD Bank’ on 29/06/2022. The said Bank vide email dated 05/07/2022 has devised the Respondent to furnish certain details to enable the ‘AD Bank’ to recommend to RBI to record approval.

between the parties and cash flow issues due to Covid 19 Pandemic. The Learned Counsel for the Respondent submitted that there was no reconciliation of the accounts and that the disputes were raised much prior to the issuance of Section

8 Payment Notice. It is submitted that the said dispute was raised in the Reply filed before the Adjudicating Authority.

6. The Learned Counsel for the Respondent drew our attention to the emails

dated 23/05/2018, 24/05/2018, 26/05/2018 and 20/07/2018, in support of his case

that there was a dispute between the Parties regarding quality of the goods. For

better understanding of the case, the first email addressed on 23/05/2018 is

reproduced as herein:

Senthil Kumar T

To wang, Mohamed, Sruthi, Mayank, Shrishail, Supriya, Basavaraj, Nithyashree, Sunil, Eshwaraiah

Hello Vijay Wang

Please see the mail from our quality, which is self explanatory on the issue we are facing with regard to the recent lot of AV cable.

Please share your response based on the feedback and check on the lots and confirm back.

Regards

Reply of the Corporate Debtor to the email

to senthilkumar, Supriya, Basavaraj, Nirthyashree, Sunil, Eshwaraiah, Suresh, me, Incoming

Dear Senthil,

We checked our finished product in warehouse. No this happen. We 100% inspection before shipping and there will be at least 2 time QC testing (Semi- finished and Finished testing)

AV Cable

If there has small quanitty broken Maybe cause by Violent handing, then i can Undertand

But now there is 15% rejection its unreasonable that we ship NG product to customer as we will pay for it also pls check the approval samples if has this issues?

This is very serious, as this connector also supplying to JIO and dish.tv

Lets work out

Best Regards

Vijay

General Manager

15888303608

9. The ‘Adjudicating Authority’ while dismissing the Application has observed as follows:

regard to the admission of liability on 31/05/2019. The ‘Adjudicating Authority’ has erred in observing that ‘Corporate Insolvency Resolution Process’ cannot be initiated against the solvent company in a pandemic situation and that it is a

recovery proceeding. To reiterate, the debt was ‘due and payable’ since May 2018 and therefore Section 10A is not applicable to the facts of this case

12. For all the aforegoing reasons, this Company Appeal (AT) (CH) (Ins) No. 280/2021 is ‘allowed’ and the Order of the ‘Adjudicating Authority’ is set aside and the matter is remanded to the ‘Adjudicating Authority’ for initiation of ‘Company Insolvency Resolution Process’ against the Corporate Debtor Company in accordance with law. Both the Parties are directed to appear before the ‘Adjudicating Authority’ on 4 th August without any further Notice. No Costs.