Kasha E. Sai. v. M/s Yarn Udyog

Kasha E. Sai.

Suspended Director of M/s Mallur

Siddeswara Spinning Mills Pvt. Ltd.

Registered Office:

Attayampatti Road Attanur Post Rasipuram

Tk Namakkal District Tn 636301

…Appellant

Versus

M/s Yarn Udyog

(Partnership Firm -1728 of 2019)

Registered office:

No. 3.6.168/6,

Hyderguda, Hyderabad – 500029.

…Respondent

Case No: COMPANY APPEAL (AT) (CH) (INS.) NO. 187/2023

Date of Judgement: 31/03/2023

Judges:

[Justice M. Venugopal]

Member (Judicial)

[Shreesha Merla]

Member (Technical)

For Appellant : Mr. E. Om Prakash, Sr. Advocate

For Ms. Anusha Peri, Advocate

Facts:

Operational Creditor (Yarn Udyog) filed an application under Section 9 of IBC before NCLT against Corporate Debtor (Mallur Siddeswara Spinning Mills) seeking to initiate insolvency resolution process. The debt claimed was Rs. 2,21,91,045/- comprising of principal amount of Rs. 1,65,60,017/- and interest of Rs. 56,31,027/- The debt was in respect of 6 invoices raised between Dec 2019 to Feb 2020 for supply of cotton bales under a barter arrangement where the Corporate Debtor had to supply yarn in exchange. The Corporate Debtor disputed the claim contending there was a pre-existing dispute pending before MSME Council which was dismissed as not maintainable. It was also contended that debt was hit by limitation under Section 10A as due dates mentioned were prior to 25.03.2020

Court’s Opinions:

- On Applicability of Section 10A IBC: Court held the invoices clearly provide for interest at 24% p.a. in case of default in payment within 30 days. As per NCLAT decision in Prashat Agarwal case, interest stipulated in invoices forms part of debt under Section 3(11). Accordingly, total debt comprising principal and interest exceeded Rs. 1 crore and limitation under Section 10A does not apply.

- On Pre-existing Dispute: Dispute raised by Corporate Debtor was illusory and not plausible. Proceedings before MSME Council were dismissed at threshold stage noting barter transactions require detailed trial. Significantly, Corporate Debtor had admitted liability and offered no defence on merits of claim before MSME Council. Relying on Mobilox Innovations case, NCLT held dispute is spurious and hypothetical to defeat insolvency application

- Other Findings: Amount claimed qualifies under amended threshold under Section 4 IBC. Default occurred on 23.03.2020 as per 30 days credit period in invoices. Section 9 application is complete and no grounds under Section 9(5) to reject it.

Sections Referred:

Sections 3(6), 3(11), 4, 9 and 10A of the Insolvency and Bankruptcy Code; Regulation 7 of the IBBI Regulations

Laws Referred:

Supreme Court decision in Mobilox Innovations v. Kirusa Software; NCLAT decision in Prashat Agarwal v. Vikash Parasrampuria

The summary covers the key facts, court’s opinions on main issues, relevant provisions and case laws referred in the judgment. Let me know if you need any clarification or have additional query.

Download Court Copy: https://dreamlaw.in/wp-content/uploads/2023/11/Kasha-E.-Sai.-v.-Ms-Yarn-Udyog-3.pdf

Full Text of Judgment:

[Per: ShreeshaMerla, Member (Technical)]

1. Challenge in this Appeal is to the Impugned Order dated 31/03/2023, passed in CP(IB) 316/BB/2021 passed by the National Company Law Tribunal, whereby the ‘Adjudicating Authority’ has admitted the Application filed under Section 9 of the Insolvency and Bankruptcy Code, 2016 (hereinafter referred to

as ‘the Code’), observing as follows:

19. As regards the contention that there are preexisting disputes as to the debts claimed, admittedly, the Applicant prior to filing this application, had initiated proceedings before MSME Council seeking the same amount claimed as outstanding but the said application was dismissed by the MSME Council simply on the

ground that the subject matter of claim is not that of a small enterprise, supply of goods or services and it pertained to supply of only raw material as a trader and there existed no other reciprocal obligations. It was held that MSMED Act, 2006 dies not provide scope for arbitration of nonMSME subject matter in dispute even if claimant is registered as MSME for other procedural reasons. It has simply held that it has no jurisdiction to conduct the arbitration in the claim between the claimant of the Applicant and the Respondent.

20. It is pertinent to note that in reply to the petition filed before the MSME Council, the Respondent had admitted the debt and pleaded that it was making all sorts of efforts to settle the outstanding dues as soon as possible. In this case, the invoices are not disputed by the Respondent. The structure of payments against the invoices is also not in dispute. The record under statement shows that a sum of Rs. 1,65,60,617/- was payable against the aforesaid invoices.

2. The Learned Counsel appearing for the Appellant has strenuously contended that the ‘Adjudicating Authority’ has not taken into consideration, the disputes which arose between the Corporate Debtor and the Operational Creditor from the year 2020 onwards, with respect to the Barter Transactions between them. The Barter Arrangement was in respect of the Operational Creditor supplying the Cotton Bales, the Corporate Debtor which in turn spins the cotton into yarn and supplies it to the Operational Creditor. It is submitted that when the disputes arose, the Operational Creditor on 18/07/2020 initiated Arbitration Proceedings before the Micro and Small Enterprises Facilitation Council (MSME Council) seeking recovery of the claimed debt said to have arisen on account of default under Invoices Nos. 85, 94, 102, 111, 112, 113 issued by the Respondent.

3. It is submitted that the MSME Council rejected the Application vide Order dated 28/09/2021 noting that ‘Adjudication of present Claim involves determination of reciprocal rights and liabilities of Barter Trading as alleged by Respondent by examining witness and voluminous evidence. The Proceedings before the Council are summary in nature and such examination of ‘Trading Transaction’ is outside the means and scope of the Council under Act 2006’. It is submitted that the MSME Council appreciated that the transactions between

the Parties was in the nature of the Barter System and would require a trial to determine outstanding liabilities and therefore dismissed the Application. During the pendency of the Proceedings before the MSME Council, the Respondent had issued a ‘Demand Notice’ under Section 8 of the Code on 05/03/2021, but had

claimed that the debt was due for default under Invoices Nos. 81, 84, 85, 94, 102, 111, 112, 113, despite having admitted before the MSME Council that Invoices No. 81 and 84 have already been paid to the Corporate Debtor. It is submitted that there was no reply to the Section 8 Notice on account of the illness of the Appellant’s father, who had passed away on 02/04/2021. It is submitted by the Learned Senior Counsel that the ‘Adjudicating Authority’ has erred in concluding that there was a debt and a default without taking into consideration that the Application was barred by Section 10A as the due dates mentioned in the Application pertain to the period under Section 10A of the Code. The Operational Creditor had provided a timeline varying from 11 days to 42 days for payment under each Invoice but in the Rejoinder they had adopted a 30 days period for payment of each Invoice which is incorrect. There are glaring inconsistencies

with respect to the Invoice Numbers as pointed out before the MSME Council and the Invoices mentioned in the Application.

4. The Learned Senior Counsel strenuously contended that the dues claimed are prior to 25/03/2020 and ‘interest’ has been calculated from that date and the date of default written in Section 9 Application is 22/02/2020 and the calculation of interest is from 01/04/2020 and therefore, is hit by Section 10A of the Code.

5. At the outset, this Tribunal addresses to the issue as to whether the Application is hit by Section 10A of the Code. A brief perusal of the Invoicesunder which the amounts are said to be in default are detailed as hereunder.

| Invoice date |

Invoice No. |

Amount of material supplied PRINCIPAL AMOUNT (Rs.) |

Due date by giving 30 days credit (as per condition No. 2 of each invoices) |

| 22.12.2019 | 85/19-20 | 28,07,676.00 | 21.01.2020 |

| 11.01.2020 | 94/19-20 | 28,64,080.00 | 10.02.2020 |

| 28.01.2020 | 102/19-20 | 28,28,733.00 | 27.02.2020 |

| 21.02.2020 | 111/19-20 | 27,81,035.00 | 22.03.2020 |

| 22.02.2020 | 113/19-20 | 28,32,115.00 | 23.03.2020 |

| 22.02.2020 | 112/19-20 | 28,37,680.00 | 23.03.2020 |

| TOTAL AMOUNT DUE | 3,91,301.00 | |

| NET PRINCIPAL AMOUNT DUE: |

1,65,60,018.00 | 23.03.2020 |

6. It is an admitted fact that there is a Barter Transaction between the two

parties in the sense that the Operational Creditor provides the Cotton Bales and

the Corporate Debtor spins it into yarn and sends back to the Operational Creditor

and hence there is a running account between the two Parties. It is the case of the

Appellant that Invoice Nos. 81 and 84 have been paid much prior to the issuance

of the Demand Notice. Hence, Invoice Numbers 85, 94, 102, 111, 112 & 113 are

being taken into consideration in the aforenoted table. For better understanding

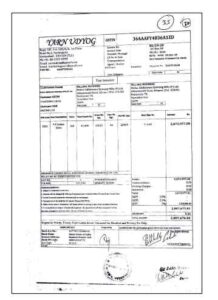

of the case, a sample Invoice that is the First Invoice dated 22/12/2019 is reproduced as herein:

7. From the aforenoted Invoice, it is clear that it is agreed between the Parties that interest would be charged at 24 % p.a., if payment is not received within 30 days from the Invoice date. Likewise, a bare reading of the aforenoted Invoice shows the interest component to be 24 % p.a. with a ‘default clause’ that if the amount is not paid within 30 days from the Invoice date, interest will be attracted. Therefore, the contention of the Learned Senior Counsel that the calculation ought to be based on 11 days to 42 days, is untenable. The NCLAT, Principle Bench in the matter of ‘Mr. Prashat Agarwal Vs. Vikash Parasrampuria & Anr.’

in Company Appeal (AT) (Ins) No. 690/2020 has held as follows:

“….. (v) Before coming to any conclusion, it will also be pertinent to go through legal definition of debt. The definition of debt as per section 3(11) of IBC is as under:-

3(11) “debt” means a liability or obligation in respect of a claim which is due from any person and includes a financial debt and operational debt. Since, the word “claim” is mention in definition of debt in Section 3(11) we need to refer to definition of claim under Section 3(6) of IBC which is as follows:

“3.(6) “claim” means

(a) a right to payment, whether or not such right is reduced to judgment, Fixed, disputed, undisputed, legal,

equitable, secured or unsecured;

(b) right to remedy for breach of contract under any law for the time being in force, if such breach gives rise to a right to payment, whether or not such right is reduced to judgment, fixed, matured, unmatured, disputed, undisputed, secured or unsecured; Since, interest on delayed payment was clearly stipulated in invoice and therefore, this will entitle for “right to payment” (Section 3(6) IBC) and therefore will form part of “debt” (Section 3(11) IBC)

(vi) It is , therefore clear from these facts that the total amount of maintainability of claim will include both principal debt amount as well as interest on delayed payment which was clearly stipulated in the invoice itself. It is noted that the total principal debt amount of Rs. 97,87,220/- along with interest the total debt makes total outstanding as Rs. 1,60,87,838/-. Thus, the total debt outstanding of OC is above Rs. 1 crore as per requirement of Section 4 IBC read with notification No. S.O. 1205(E) dated 24.03.2020 (Supra), and

meets the criteria of Rs. 1crore as per Section 4 of IBC and Application is therefore maintainable in present case.”

(Emphasis Supplied)

8. From the aforenoted ratio, it is clear that the total amount for maintainability of Claim will include both ‘Principal Debt amount’ as well as the ‘Interest’ on the delayed payment which is stipulated in the Invoice dues. In the instant case, the Principal amount is said to be Rs. 1,65,60,017/- and the interest portion at 24 % as per the second Clause in Invoice No. 2 is Rs. 56,31,027/-. Therefore, this Tribunal is of the considered view that the amount has crossed the threshold of Rs. 1,00,00,000/- and also that the amounts due and payable are for a period prior to 25/03/2020. The date of default mentioned in the Section 9 Application is 22/02/2020. Therefore, it is clear that for any amounts due and payable prior to 25/03/2020, Section 10A cannot be made applicable.

9. The next issue raised by the Learned Counsel is with respect to a ‘pre existing dispute’ between the Parties as there was a ‘Barter Transaction’ and when the Respondent / Operational Creditor had initiated Arbitration Proceedings under the MSME Council. It is not in dispute that this Application was dismissed with an observation that such kind of trading activities requires voluminous evidences and therefore, cannot be adjudicated by the MSME Council. It is seen from the record that the MSME Council has rejected the Application and there is no Claims / Suit pending in any Court of Law before any Tribunal and there is no

Arbitration Proceeding pending prior to the initiation of the Section 8 Notice. Additionally, the Appellant had stated in Para 8 of their Counter, that a payment of Rs. 40,000/- was made on 10/08/2021, 09/09/2021, 12/10/2021 & 22/03/2022 which further establishes that some amounts were paid even subsequent to the

filing of the Application before the MSME Council. The Hon’ble Apex Court in the matter of ‘Mobilox Innovations Pvt. Ltd. Vs. Kirusa Software Pvt. Ltd’ reported in [(2018) 1 SCC 353] has addressed to the question of ‘pre existing dispute’ and observed as follows:

“It is clear, therefore, that once the operational creditor has filed an application, which is otherwise complete, the adjudicating authority must reject the application under Section 9(5)(2)(d) if notice of dispute has been received by the operational creditor or there is a record of dispute in the information utility. It is clear that such notice must bring to the Notice of the Operational creditor the ‘existence’ of the dispute or the fact that a suit or arbitration proceeding relating to a dispute is pending between the parties. Therefore, all that the Adjudicating Authority is to see at this stage is whether there is a plausible contention which requires further investigation and that the ‘dispute’ is not a patently feeble legal argument or an assertion of fact unsupported by evidence. It is important to separate the grain from the chaff and to reject a spurious defence which is a mere bluster. However, in doing so, the Court does not need to be satisfied that the defence is likely to succeed. The Court does not at this stage examine the merits of the dispute except to the extent indicated above. So long as dispute truly exists in fact and is not spurious, hypothetical, or illusory, the Adjudicating Authority has to reject the application.”

(Emphasis Supplied)

10. This Tribunal is of the considered view that the ratio of the aforenoted Judgment is squarely applicable to the facts of this case as this Tribunal is of the considered view that the ‘Dispute’ raised is a spurious one and is an illusory one. Additionally, it is significant to mention that before the very same ‘MSME Council’, the Appellant / Corporate Debtor in his Reply, in Paras 4 and 5 (Reply to MSME Annexure A4) has clearly admitted that the ‘reason for delay of settlement of outstanding amounts is not wanton and that Company is making all sorts of efforts to settle the outstanding dues as soon as possible’. It is also stated in Para 5 that ‘there is no intention on the part of the Company to delay or deny the actual liability towards the Petitioner Company’. Keeping in view, the clearcut Admission of Liability, the fact that the amounts are ‘due and payable’ prior to 25/03/2020 and that there is ‘no pre-existing dispute’ as defined under the Code, this Tribunal is of the earnest view that there is no illegality or infirmity in the Order impugned, dated 31/03/2023 in C.P.(IB) No. 316/CHE/2021.

11. For all the aforegoing reasons, this Company Appeal (AT) (CH) (Ins) No. 187/2023, is dismissed accordingly. No Costs. Connected pending ,Interlocutory Applications’, if any, are ‘closed’.